From $5 McDonald's Dinners to $25M Fundraises: How Chen Li Cracked the B2C Code with Palmstreet

Live from EntreConnect's Founder Keynote Series

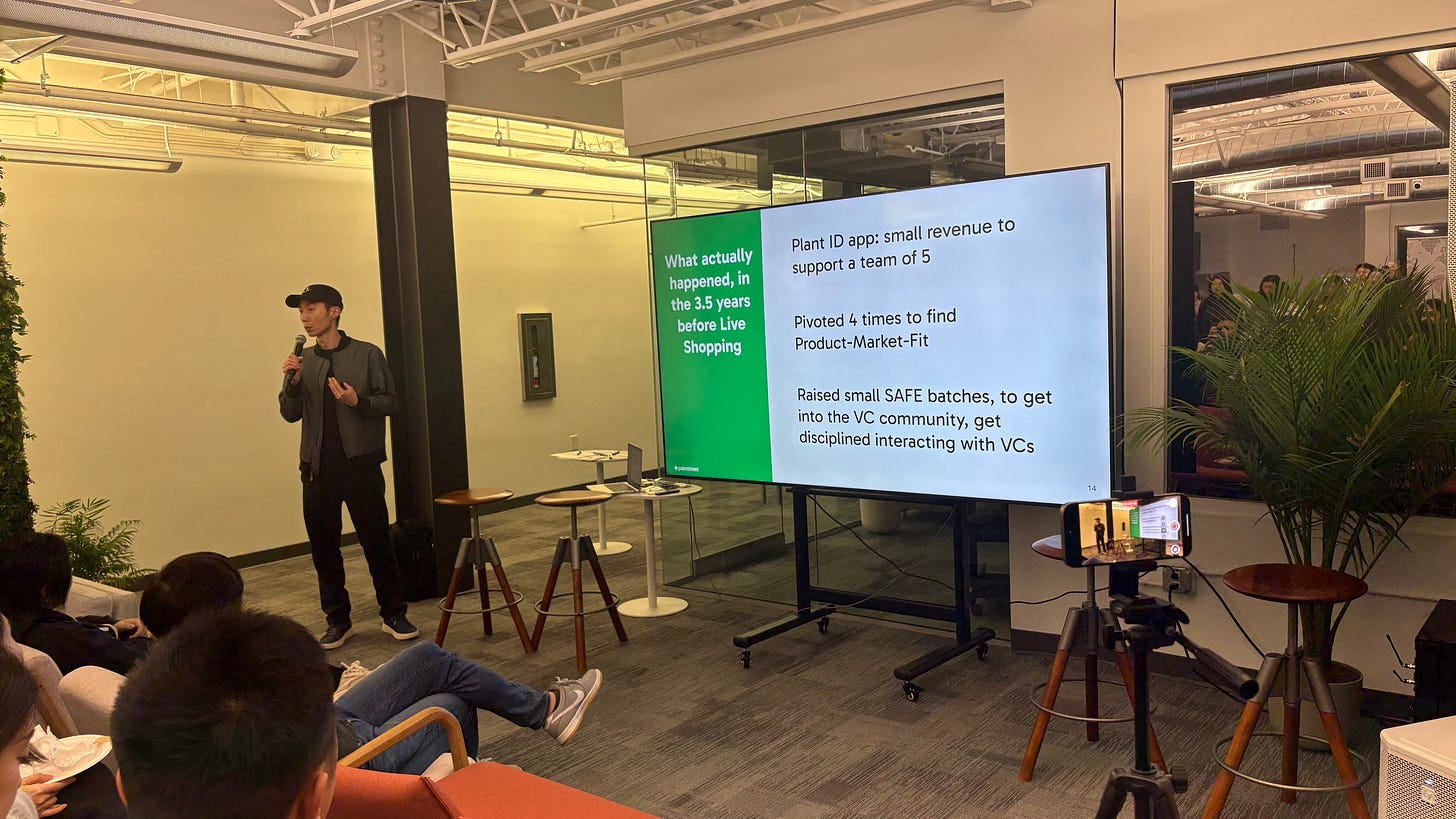

Palmstreet, a fast-growing live shopping platform for rare plants, crystals, and handcrafted goods, recently announced a milestone $25M in funding backed by powerhouse investors including Andreessen Horowitz, Craft Ventures, Headline, and more. For many, this might look like an overnight success—but for founder Chen Li, the journey from side-project to startup rocketship was anything but easy.

At our recent EntreConnect event in Palo Alto, Chen shared his zero to one rollercoaster, one that involved failed pivots, 50 cold calls per seller, late-night McDonald's, and a deeply held belief: “If it’s hard, it probably means you are the only one who can solve it.”

Let’s dive into the journey of how Chen cracked the B2C code—plant by plant, pitch by pitch.

🌱 Humble Roots: A Plant ID App and the Spark of an Idea

It all began in 2020, when Chen—a hiking enthusiast—started snapping photos of plants along his trail and found himself wondering, "What are these called?" Frustrated by the lack of good tools to identify plants, he decided to build one himself. He discovered a biology PhD in the Czech Republic who had trained a machine learning model to recognize plants. Rather than building the AI from scratch, Chen integrated the model into a lightweight mobile app, routed user-submitted photos through it, and returned the results—often with personalized commentary added by Chen himself.

Then, the pandemic hit. People were suddenly spending more time at home, reconnecting with nature, tending to their gardens, and, like Chen, becoming curious about the greenery around them. "People were stuck at home, in their gardens, taking pictures of plants," Chen said. The timing couldn’t have been more serendipitous. His app saw a surge in interest, eventually reaching nearly 1 million downloads. The modest but growing revenue was enough to support a small team of five and validate the need.

But as interest surged, engagement quickly faded. "Retention was poor," Chen admitted. "People ID their plant once… and then never come back." It was clear the utility was episodic. To build something enduring, Chen realized he’d need to find a way to make plant lovers come back—again and again.

🌀 Four False Starts: Pivots That Didn’t Work

Chen wasn't ready to give up. Instead, he and his team embarked on a rapid-fire exploration of what might work. They launched:

A plant watering reminder app to build daily utility

A social media app for plant lovers to foster community

A mega-app that combined every feature they'd tried, hoping that more would mean better

A photo-based Etsy-style marketplace, betting on the visual charm of rare plants

Each idea had its moment of optimism, but none stuck. "I worked at Instagram and Facebook. I've seen good retention. These weren't it," Chen admitted. The data simply didn’t back up the excitement. Engagement was shallow, churn was high, and PMF remained elusive.

The turning point came unexpectedly during a plant trade show in Miami. Palmstreet rented a booth and posed as a large plant retailer. The goal wasn’t to sell, but to observe and learn: how were sellers actually selling?

"We realized sellers were already doing Instagram Live sales," Chen said. "But Instagram was super slow—five-second delay. Yet they were making thousands every night. That told us the demand was real. The experience just needed to be 10x better."

That insight—watching real sellers hack together live commerce with the wrong tools—would shape the foundation of what Palmstreet became next.

📹 MVP with Duct Tape: The Scrappy Sprint

Chen’s team didn’t jump straight into building software. They wanted proof before committing time and resources. So they started with the most basic test: one employee went live on Instagram, reselling plants she had picked up from local stores. There was no backend, no product—just a script, a phone, and curiosity.

To their surprise, viewers didn’t just tune in—they bought. After a few sessions, repeat customers began showing up. By week four, she had a loyal following, with people messaging her between streams and asking when the next one would be.

They knew they were onto something.

"We rented an Airbnb, flew the whole remote team in, and hacked together our live shopping app in eight weeks," Chen recalled. The house became their war room. Laptops were propped on kitchen counters, engineers camped in bedrooms, and every day brought a new fire drill. "It crashed every ten minutes, but people still bought."

They were running on ramen, cold brew, and adrenaline. But what they were building—no matter how scrappy—was resonating.

That early validation gave them the confidence to double down, shift focus fully, and rally behind what would soon become Palmstreet's defining product.

🚀 The Marketplace Flywheel: Sellers, Then Buyers

"No big seller trusted us," Chen said. "So we started with small sellers—the ones no one else was paying attention to." These early sellers had limited followers and limited options. Palmstreet bought a portion of their inventory just to get things moving and made sure their first streams were successful.

To help, the team manually promoted each stream across platforms like Reddit, Facebook, and Instagram. "We did everything to make them successful," Chen emphasized.

As these sellers gained traction, bigger sellers took notice—bringing their audiences and further fueling demand. The flywheel had begun to spin.

As categories expanded from plants to crystals, handmade pottery, and eventually reptiles, retention soared. Chen explained, "We introduced dual streams so sellers could collaborate live, auctions to drive engagement, even mini-games so buyers could interact with sellers directly. The human touch changed commerce. We weren’t just selling products—we were recreating the feeling of walking through your favorite local market, but online."

💰 Rejection, Iteration, and the Fundraising Hustle

Before Product-Market Fit (PMF), Palmstreet only raised small SAFE rounds. "Even if we didn't need the money, it got us into the discipline of sending updates to VCs. That discipline paid off."

Then came the seed round. Chen met with over 20 firms. Every day, it was Zoom pitches in the morning, McDonald's lunches downtown, and in-person meetings in Menlo Park in the afternoon.

"I would tell them: 'I need $5 million.' Most rejected me the next day," Chen laughed. "But every rejection helped me refine the story."

Eventually, Andreessen Horowitz led their seed at month 6. Crust Ventures led their Series A by month 12. Series A+ came by month 18.

And today, Palmstreet has raised $25M to continue shaping the future of live shopping.

🪖 The Founder's Fire: Scaling with Intention

Chen thought fundraising would give him room to breathe. "But after our seed, I started working 16-hour days. Suddenly, you’re on a treadmill of expectation. The bar rises, and so does the pressure to deliver fast, consistently, and flawlessly."

Instead of scaling back, he leaned in. He spent 30% of his time on hiring—personally reaching out to candidates, crafting compelling pitches to top-tier talent, and ensuring every hire fit not just the skill needs but also the culture he was building.

He dove deep into the P&L, obsessing over burn rate, unit economics, and CAC-to-LTV ratios. He handled angry customer messages himself, not to micromanage, but to truly understand the frictions that mattered most. He set the tone for a high-ownership, low-ego culture: "If it’s hard, it means it can’t be outsourced. Founders must do it."

At one point, Palmstreet team members attended over 50 trade shows in a single year. Chen himself was often on the road, walking booths, chatting with sellers, building trust handshake by handshake. "You can't outsource trust," he said. "You show up. Again and again. That's how you win trust in the early days."

✨ McDonald’s vs Millions: Lessons from the Ground Floor

One of the most unforgettable moments of Chen's keynote was when he described his daily grind during the fundraising days. Each morning, he would pitch over Zoom from his apartment. Then, he’d grab a $5 chicken sandwich at McDonald's—not just for the price, but for the moment of mental reset. In the afternoon, he'd walk into some of the most prestigious VC offices in Menlo Park and confidently pitch them on a $5 million raise.

"From $5 meals to $5 million asks," he joked, "those were the reps that made me sharper."

And the grind didn’t stop there. To onboard sellers in the early days, Chen would make 50+ cold calls a day. When that didn’t work, he’d fly out to meet them in person. He shared stories of buying sellers dinner just to convince them to give Palmstreet a chance. "We had bugs. Lots of them. But I had to get sellers to trust the vision."

Sometimes, he even paid sellers to stay on the platform when things broke. That kind of scrappy determination defined Palmstreet's earliest growth.

He also talked about the mindset of making friends with failure: "The person who gets rejected the most is the one who learns the fastest," he said. "Every no teaches you something."

Another key lesson: recruiting top talent. "If you want people smarter than you to join, you can't just show them a job offer. You have to sell them a dream."

Whether it was attending 50+ trade shows a year or onboarding one seller at a time, Chen’s message was clear: success is not a straight line. It's a messy loop of hustle, humility, and relentless iteration.

🚀 Why Chen’s Story Resonates

Because it’s real.

Chen's story isn't built on hype—it’s grounded in hustle. It’s about testing ideas scrappily, listening to customers, and showing up day after day. He built trust one seller at a time, turned failures into learning loops, and sold a vision before the product was perfect.

It’s a reminder that big things start small—and that resilience, not resources, often makes the difference.

That’s what cracking the B2C code really looks like.

🔥 Loved Chen’s story? Want more raw, tactical wisdom from founders who’ve walked the path?

Follow us on LinkedIn and RSVP for our next event on Luma.

Your next insight—or investor—might just be one event away.

🗓️ Upcoming Events

Follow us on Linkedin and Luma to stay updated on future events!

June 7-8, Cupertino, CA | AI Workshops & Award Winning Hackathon for Young Scholars. We’re thrilled to partner with SVYoungScholars to support the aspirations of future entrepreneurs.

June 12, Mountain View, CA | How to Raise from Top VCs and Save Millions on Taxes: Money Tips for Founders Who Actually Want to Win, with Healy Jones of Neo (top VC accelerator for rising founders) and Echo Zhong of Zhong & Sanchez (AI-powered CFO and tax firm for startups) for an insider dinner on how to raise smarter, save big on taxes, and master your founder finances.

June 13, San Francisco, CA | How Agents Will Revolutionize Future of Data: Unicorn Founders & C-Suite from Neon, Gen, Datastrato & Aisera @AWS GenAI Loft—including the Founder & CEO of Neon ($130M raised, unicorn acquired by Databricks for ~ $1 billion), Gen’s Chief AI Officer, Founder & CEO of Datastrato, and Aisera’s ex-VP of AI.

June 26, Mountain View, CA | AI & Agents: Most Exciting Use Cases & Opportunity for Enterprise Tech. Join us for a provocative, content-rich presentation and Q&A with Muddu Sudhakar, unicorn founder and founding CEO of Aisera

July 15, New York, NY | 2025 AI for Greater Good. EntreConnect is thrilled to co-host the AI Hackathon with Gemi.AI, harnessing the transformative power of AI to drive ethical innovation, social impact, and sustainability.

July 30, San Francisco, CA | Infrastructure & Agentic Workflows with C-suite from MongoDB, Databricks, AppsFlyer and more, @AWS GenAI Loft